If you are not sure what exactly is End of Service Gratuity in Qatar is and how to calculate it, we’re here to help you. According to Qatar Labor Law, End of Service Gratuity is an amount of money demanded to be paid to an employee based on the length of the service period. End of Service Gratuity is calculated based on the number of years you’ve worked for the company and the employment contract.

Qatar’s Ministry of Administrative Development, Labor and Social Affairs (MADLSA) offers an online service where applicants can calculate the end of service gratuity using their official website. If you’d like to know more about the Labor Law related to the End of Service Gratuity and how to calculate it using the online tool by the Ministry, keep on reading!

Table of Contents

How to Calculate End of Service Gratuity Using the MADLSA Website

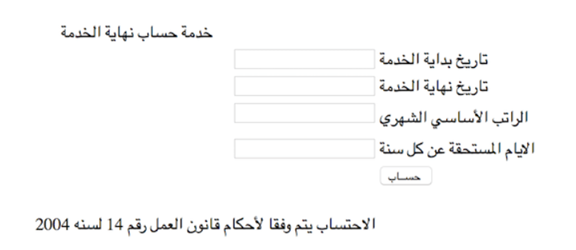

To calculate the end of service gratuity on the Ministry website is by entering the joining date, last working date, basic monthly salary, and number of gratuity days for each year. Currently, the service is only available in Arabic, but non-Arabic speakers can easily calculate ESB. All they have to do is follow these steps:

Step 1: Open the calculation page, where you will see the following fields written in Arabic:

Step 2: In the first field, enter your Date of Joining, as per your contract

Step 3: In the second field, enter your Last Working Date

Step 4: In the third field, enter your Basic Monthly Salary, as per your contract

Step 5: Fourth field is where you should enter the Gratuity Days accrued for each year (21 days for one year, for example). You have to check your contract for this one.

Step 6: The last step is to click on the bottom button and see your result!

The end of the service gratuity is calculated under the Labor Law No. 14 of 2004.

What the Law Says about End of Service Gratuity in Qatar

After the termination of the employment contract, an employee qualifies for end of service gratuity and leave salary. According to the Article 54 of the Labor Law (Law No. 14 of 2004), the employee is qualified for a minimum of three weeks basic salary for each year of employment, as the end of service gratuity.

The Article 81 of the Labor Law states that, if the employment contract is terminated before the employee takes his annual leave, the worker becomes qualified to payment in lieu of annual leave equivalent to the wage for the leave days which he is qualified for.

The employer is responsible for returning the worker back to the place from where he was recruited, or any other place that was agreed by both parties. If the employee joins another employer before they leave the country, the obligation shifts to the new employer.

Article 15 of Law No 14/2004 states:

‘In addition to any amounts due to the Worker at the end of his/her term of service, the Employer shall pay an end-of-service gratuity to the Worker who has been employed for a period of one full year or more as of the effective date of this Law.

The Gratuity shall be determined and agreed by both parties, provided it is not less than a three-week-pay for each year of service.

The Worker is further entitled to get a gratuity for fractions of the year based on the entire duration of service proportionately. The Employer shall be entitled to deduct from the gratuity the amounts the Worker owes to the Employee.’

The basic salary should be the base for the gratuity’s calculation. The employer is also qualified to deduct from the gratuity any due amount that shall be paid by the worker.

Does Working for More Than Five Years Means That the Gratuity is Higher?

The current law states that gratuity shall be agreed upon by both parties, the employer and employee, only if it is not less than a three-week remuneration for each year that the employee worked for this employer.

According to the old Labor Law, worker should be paid 4 weeks a year for working 5-10 years, and 5 weeks if they’ve worked for more than 10 years. That clause was part of the old law and it is no longer valid.

What Happens with the Gratuity if the Worker Dies?

In accordance to Article 55 of the Labor Law, if the worker dies during the service, in addition to the end of service gratuity, the employer must deposit with the treasury of the competent court any wage, or any other entitlements due to the worker, within a period not exceeding fifteen days from the date of the worker’s death. This applies for any case, no matter the cause of death.

The competent court must distribute the deposited amount among the deceased worker’s family, in accordance with Islamic Sharia provisions or the Personal Status Law that is applicable in the worker’s home country.

In case that three years have passed since the date of deposit without knowing the person that’s deserving of the amounts, the court must transfer the amounts to the State Public Treasury.

Can the Employer Terminate Employee Without Gratuity?

Article 61 of the Labor Law states that there are some situations in which the employer may dismiss a worker without the payment of the end of service gratuity. These are the instances for such misconduct:

- Violation of written instructions relating to the safety of the worker

- Employee intoxication in the workplace

- Disclosure of secret information relating to the employer

5 comments

Can the employer rejects/deny paying the gratuity of his employee? what will happen to the expected gratuity if sponsorship was transferred/sold to another sponsor? who will pay the gratuity – the previous or the current sponsor?

Did house maid can receive graduity here in Qatar? please help my question…

Yes, please check the contract.

I want tje documents for gratuity of ghe housemaid

Can u help me what is the procedure so I can my gratuity I am a house maid in Qatar I am working 3year 4months in my employer now…please help me so I know what I do thank u